Zoho Payroll streamlines payroll processing, offering a comprehensive suite of features designed to simplify payroll management for businesses of all sizes. From its intuitive interface to robust integrations, Zoho Payroll aims to reduce administrative burdens and enhance efficiency. This exploration will delve into its core functionalities, pricing models, and overall user experience, comparing it to competitors and highlighting its strengths and weaknesses.

We’ll cover everything from setting up your account and processing your first payroll to leveraging advanced features like reporting and analytics. We’ll also discuss Zoho Payroll’s security measures, customer support options, and its suitability for various business types and sizes. Whether you’re a small startup or a larger enterprise, understanding Zoho Payroll’s capabilities is crucial in making an informed decision about your payroll management system.

Zoho Payroll Features

Zoho Payroll is a cloud-based payroll solution designed to streamline the payroll process for businesses of all sizes. It offers a range of features aimed at simplifying tasks, improving accuracy, and ensuring compliance with tax regulations. This section will delve into the core functionality of Zoho Payroll and compare it to a popular competitor.

Payroll Processing Capabilities

Zoho Payroll’s core strength lies in its automated payroll processing. Users can easily input employee information, salary details, deductions, and benefits. The system then automatically calculates net pay, generates payslips, and prepares various payroll reports. Features like direct deposit integration further enhance efficiency, reducing manual effort and minimizing errors. The system supports various payment methods, providing flexibility for employers and employees.

Furthermore, it offers robust reporting capabilities, allowing businesses to track payroll expenses, analyze compensation trends, and comply with various reporting requirements.

Zoho Payroll vs. Gusto: Feature Comparison

The following table compares key features of Zoho Payroll and Gusto, a popular alternative payroll software.

| Feature | Zoho Payroll | Gusto | Comparison Notes |

|---|---|---|---|

| Payroll Processing Automation | Highly automated, with features for direct deposit and various payment methods. | Highly automated, with similar features for direct deposit and payment options. | Both offer robust automation, though specific features may vary slightly. |

| Tax Compliance | Supports multiple countries, with automatic tax calculations and filings. | Supports multiple countries, with automatic tax calculations and filings. | Both platforms aim for comprehensive tax compliance, but the specific countries supported may differ. Check their websites for the most up-to-date information. |

| Employee Self-Service Portal | Provides employees with access to view payslips, tax documents, and other payroll-related information. | Offers a similar employee self-service portal with access to pay stubs and other relevant documents. | Both platforms empower employees with self-service options, improving transparency and communication. |

| Reporting and Analytics | Offers a variety of reports for tracking payroll expenses, analyzing compensation trends, and complying with reporting requirements. | Provides comprehensive reporting and analytics dashboards for similar purposes. | Both offer strong reporting capabilities, enabling data-driven decision-making regarding compensation and payroll management. |

| Integrations | Integrates with other Zoho applications and third-party tools. | Integrates with various accounting and HR software. | The specific integrations available will influence the overall workflow and efficiency within your existing tech stack. |

Tax Compliance Features and Supported Countries

Zoho Payroll boasts comprehensive tax compliance features designed to ensure businesses adhere to relevant regulations. The software automatically calculates and files taxes, reducing the administrative burden on employers. While the exact list of supported countries is subject to change and should be verified on Zoho’s official website, Zoho Payroll generally supports a significant number of countries, including (but not limited to) the United States, Canada, the United Kingdom, Australia, and India.

The specific tax regulations and compliance requirements vary by country, so businesses should ensure they understand the applicable rules and regulations for their location. Failure to comply with tax laws can result in penalties and legal issues. Zoho Payroll aims to simplify this process, but businesses still retain ultimate responsibility for accurate tax filings.

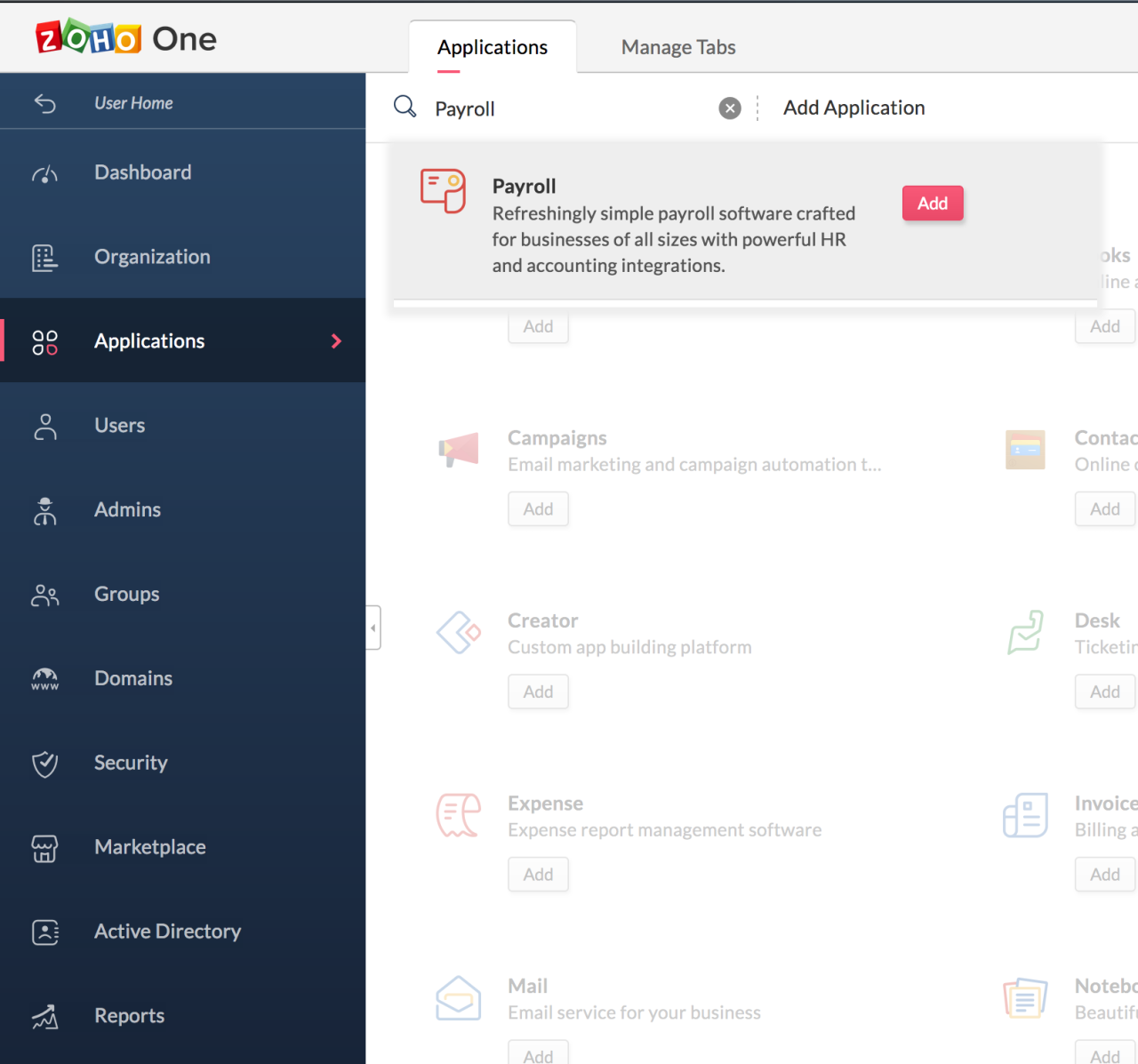

Zoho Payroll Integrations

Zoho Payroll’s strength isn’t just in its core payroll functionality; it’s also in its ability to seamlessly integrate with other business tools. This integration streamlines workflows, reduces manual data entry, and ultimately saves you time and money. By connecting Zoho Payroll to your existing software ecosystem, you create a more efficient and interconnected business operation.Zoho Payroll offers a wide array of integrations, enhancing its utility for businesses of all sizes.

These integrations eliminate the need for manual data transfer between different applications, minimizing errors and boosting productivity. The resulting efficiency allows businesses to focus on strategic growth rather than tedious administrative tasks.

Integrated Software Applications

The power of Zoho Payroll is amplified through its compatibility with a variety of popular business applications. These integrations allow for a unified view of your business data, streamlining operations and improving decision-making.

- Zoho CRM: Provides a seamless flow of employee data between payroll and customer relationship management.

- Zoho Books: Facilitates the automatic transfer of payroll expenses to accounting, simplifying financial reporting.

- Zoho People: Offers centralized employee management, including onboarding, performance reviews, and more, directly connecting to payroll data.

- Xero: Allows for data synchronization between Zoho Payroll and Xero accounting software, providing a complete financial picture.

- QuickBooks Online: Similar to Xero, this integration enables seamless data transfer between Zoho Payroll and QuickBooks for accurate financial reporting.

- Other Integrations: Zoho also offers integrations with various HR and other business applications. The specific integrations available may vary based on your region and subscription plan. Check Zoho’s website for the most up-to-date list.

Benefits of Zoho Payroll Integrations

The benefits of utilizing Zoho Payroll’s integration capabilities are substantial and impact various aspects of business management. These advantages translate to improved efficiency, reduced errors, and a more streamlined workflow.

- Reduced Data Entry Errors: Automated data transfer minimizes manual input, significantly reducing the risk of human error.

- Improved Accuracy: The seamless flow of information ensures accurate payroll processing and financial reporting.

- Increased Efficiency: Automating tasks frees up valuable time for employees to focus on more strategic initiatives.

- Enhanced Collaboration: Integrated systems promote better communication and collaboration between different departments.

- Better Decision-Making: A unified view of business data allows for more informed and strategic decision-making.

Zoho CRM Integration: Streamlined Workflows

The integration between Zoho Payroll and Zoho CRM significantly enhances business workflows, particularly for sales-driven organizations. For example, imagine a sales team that needs to track employee commissions based on sales performance. With this integration, commission calculations are automatically updated in Zoho Payroll based on data in Zoho CRM, eliminating manual calculation and reconciliation. This not only saves time but also ensures accurate and timely commission payments, boosting employee morale and productivity.

The streamlined data flow ensures that payroll accurately reflects sales performance, fostering transparency and accountability. This integration exemplifies how Zoho’s ecosystem enhances overall operational efficiency.

Zoho Payroll Pricing and Plans

Choosing the right payroll software can feel like navigating a minefield, but understanding the pricing and features is key. Zoho Payroll offers various plans to cater to businesses of all sizes, from solopreneurs to larger enterprises. Let’s break down what each plan offers and how it can save you time and money.

Zoho Payroll’s pricing model is designed to be flexible and scalable. They offer a tiered system, allowing you to choose a plan that aligns with your specific needs and budget. While precise pricing can change, it’s generally structured to accommodate the number of employees you need to pay.

Zoho Payroll Pricing Tiers and Features

The following table provides a general overview of Zoho Payroll’s pricing plans and their included features. Keep in mind that prices and features are subject to change, so it’s always best to check the official Zoho website for the most up-to-date information. This table reflects typical offerings and should be used as a guideline.

| Plan Name | Price (Approximate Monthly) | Included Features | Limitations |

|---|---|---|---|

| Basic | $0 – $20 (depending on employee count and features) | Payroll processing for a limited number of employees, basic reporting, direct deposit. | Limited number of employees, fewer reporting options, may lack advanced features. |

| Standard | $20 – $50 (depending on employee count and features) | Payroll processing for a larger number of employees, enhanced reporting, direct deposit, tax calculations, time tracking integration (may require additional add-on). | May not include all advanced features like benefits administration or comprehensive HR tools. |

| Premium | $50+ (depending on employee count and features) | Payroll processing for a large number of employees, comprehensive reporting, direct deposit, tax calculations, time tracking integration, benefits administration, advanced HR features (often requires additional add-ons). | Higher cost, may require a higher level of technical understanding. |

Cost Savings with Zoho Payroll

Switching to Zoho Payroll from manual payroll processing can result in significant cost savings in several ways. Manual payroll is incredibly time-consuming, requiring dedicated staff hours to manage calculations, tax filings, and direct deposits. These labor costs can quickly add up.

Zoho Payroll automates many of these processes, reducing the need for dedicated payroll personnel. Furthermore, its accurate tax calculations minimize the risk of penalties and fines associated with errors in manual processing. The software’s efficiency translates directly into reduced administrative overhead and increased productivity.

Consider a small business with five employees spending an average of 10 hours per month on payroll tasks at a rate of $25 per hour. That’s $1250 per month just on labor. Zoho Payroll, even at its higher tiers, would likely cost significantly less than this, offering substantial cost savings and allowing employees to focus on other crucial business aspects.

Zoho Payroll User Interface and Experience

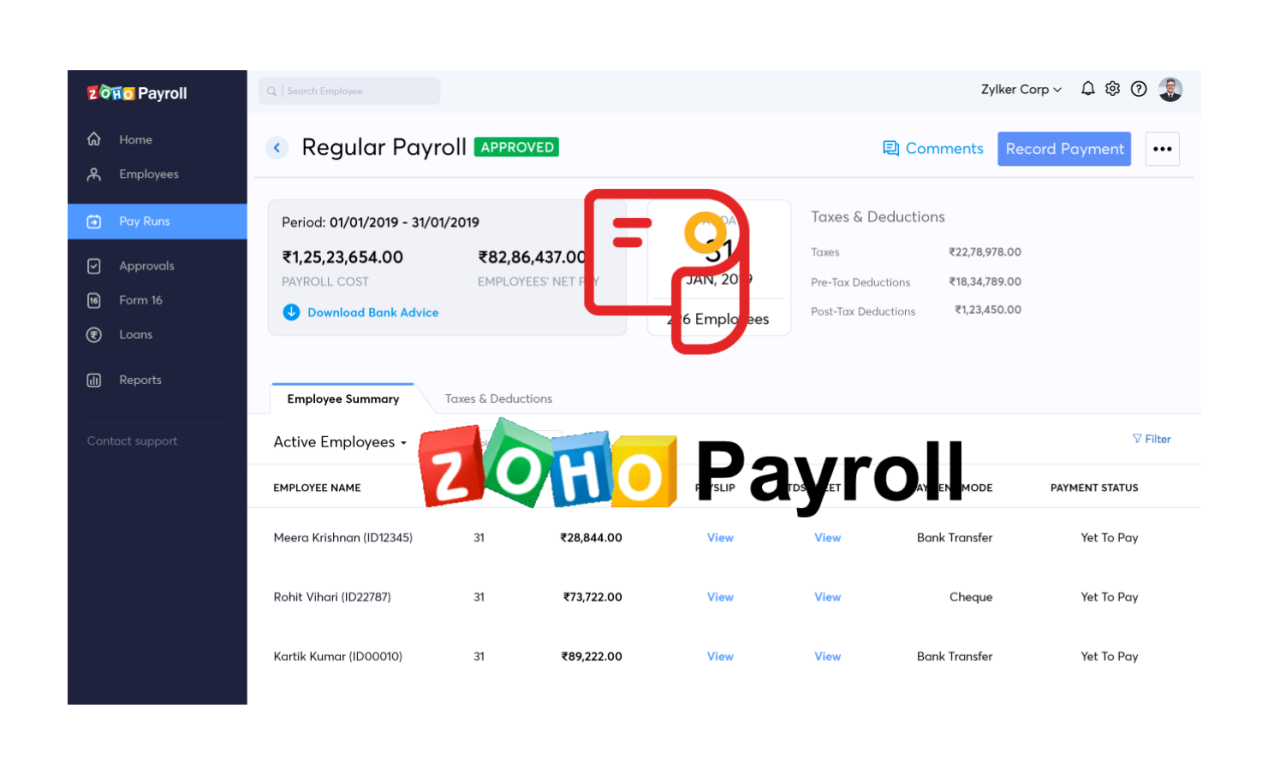

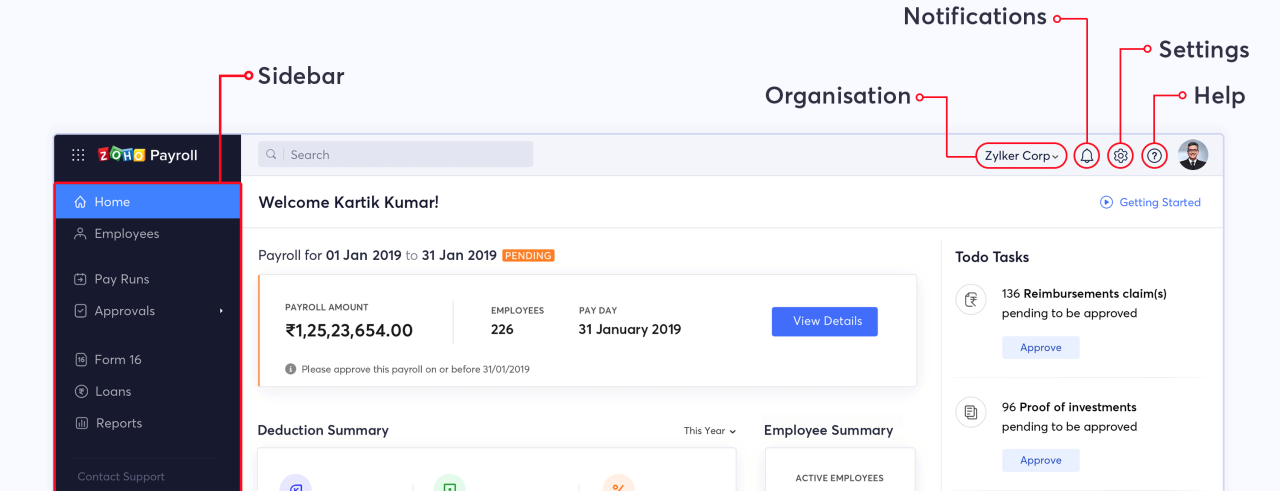

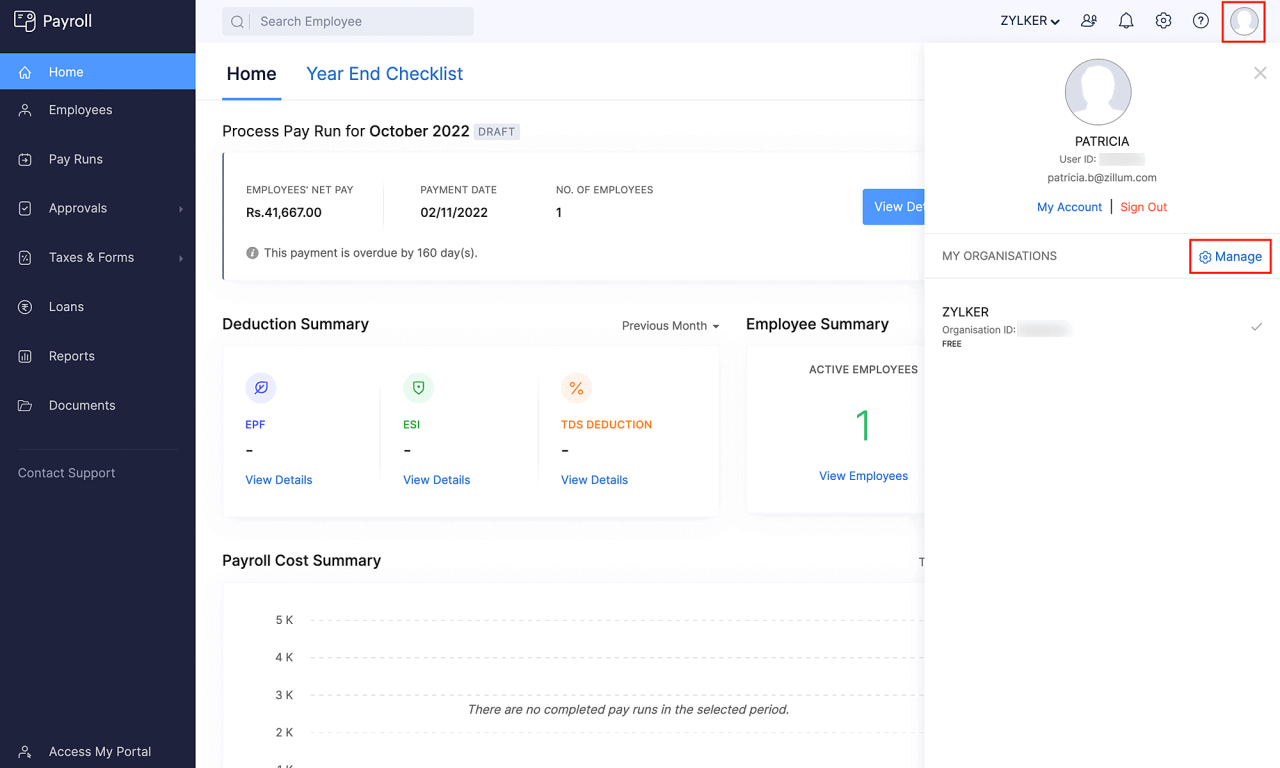

Zoho Payroll boasts a clean and intuitive interface designed for ease of use, even for those with limited payroll experience. Its straightforward navigation and well-organized features minimize the learning curve, allowing users to quickly become proficient in managing their payroll processes. The overall design prioritizes efficiency and a user-friendly experience.Zoho Payroll’s interface is characterized by a clear and logical layout.

Key features are easily accessible through a well-structured menu system, and the dashboard provides a quick overview of important information, such as upcoming payroll deadlines and employee payment statuses. The system is designed to guide users through each step of the payroll process, minimizing potential errors and ensuring accuracy.

Navigating the Zoho Payroll System

The primary navigation bar typically sits at the top of the screen, providing access to core modules like Employees, Payroll, Reports, and Settings. Each module is further broken down into sub-sections, making it easy to locate specific functions. For instance, within the “Employees” module, users can manage employee information, including personal details, compensation, and tax information. The “Payroll” module allows users to initiate payroll runs, view payment summaries, and manage direct deposits.

The intuitive structure minimizes the need for extensive training or searching through numerous menus.

A Hypothetical Payroll Run

Let’s imagine Sarah, the HR manager at a small bakery, needs to run payroll for her five employees. First, she logs into Zoho Payroll and navigates to the “Payroll” module. She reviews the employee list to confirm all hours worked have been correctly inputted. Then, she selects the current pay period and reviews the calculated payroll amounts, including gross pay, deductions (taxes, benefits), and net pay.

Sarah can make any necessary adjustments before confirming the payroll run. Finally, she approves the payroll, initiating the payment process to the employees’ designated accounts. The entire process, from start to finish, is streamlined and can be completed in a matter of minutes, thanks to Zoho Payroll’s user-friendly design. Sarah can then easily generate reports to track payroll expenses and ensure compliance with relevant regulations.

The system also provides email notifications to both Sarah and her employees, keeping everyone informed throughout the process.

Zoho Payroll Security and Data Privacy

Protecting your sensitive employee data is paramount, and Zoho Payroll understands this. They employ a multi-layered security approach to ensure the confidentiality, integrity, and availability of your payroll information. This involves robust technical safeguards, adherence to industry best practices, and commitment to relevant data privacy regulations.Zoho Payroll’s security measures are designed to prevent unauthorized access, use, disclosure, alteration, or destruction of your data.

These measures are constantly reviewed and updated to adapt to evolving threats in the cybersecurity landscape.

Data Encryption

Zoho Payroll uses encryption both in transit and at rest to protect your data. Data encryption transforms your sensitive information into an unreadable format, making it incomprehensible to unauthorized individuals. This means that even if someone were to gain access to your data, they wouldn’t be able to understand it without the decryption key. This process protects payroll information such as employee salaries, bank details, and tax information.

Access Control and Authentication

Zoho Payroll implements strict access control measures, ensuring that only authorized personnel can access your payroll data. This includes multi-factor authentication (MFA), which adds an extra layer of security by requiring multiple forms of verification before granting access. Role-based access control (RBAC) further restricts access based on individual user roles and responsibilities, preventing unauthorized users from accessing sensitive information.

Zoho Payroll is awesome for managing employee compensation, but sometimes you accidentally delete important payroll files! If that happens, don’t panic; you can try using a data recovery tool like recuva to get them back. After recovering your files, you can easily re-import them into Zoho Payroll, minimizing any disruption to your workflow.

For instance, a standard employee might only see their own payslip, while an administrator would have access to the entire payroll database.

Data Backup and Disaster Recovery

Zoho Payroll maintains regular data backups to protect against data loss due to hardware failure, natural disasters, or cyberattacks. These backups are stored securely in geographically diverse locations to ensure business continuity and data recovery in the event of an unforeseen incident. Their disaster recovery plan includes procedures to restore data and systems quickly and efficiently, minimizing downtime and data loss.

This is crucial for ensuring payroll processing can continue without significant disruption.

Compliance with Data Privacy Regulations

Zoho Payroll demonstrates a commitment to complying with various data privacy regulations, including the General Data Protection Regulation (GDPR) in Europe and other regional regulations. This includes implementing appropriate technical and organizational measures to protect personal data, providing individuals with control over their data, and responding promptly to data breach notifications. Their commitment to compliance ensures they meet the standards required for handling sensitive employee information according to legal frameworks.

For example, they offer data subject access requests (DSAR) functionality, allowing employees to access, correct, or delete their personal data.

Security Audits and Certifications

Zoho Payroll undergoes regular security audits and assessments to identify and address any vulnerabilities. They also pursue relevant security certifications to demonstrate their commitment to maintaining high security standards. These audits and certifications provide independent verification of their security posture and help build trust with their users. The specific certifications held may vary, but they serve as evidence of their dedication to data security and compliance.

Zoho Payroll Customer Support

Zoho Payroll, like any software, relies heavily on its customer support to maintain user satisfaction and address inevitable issues. A robust and responsive support system is crucial for a smooth user experience, especially given the sensitive nature of payroll processing. The effectiveness of Zoho Payroll’s customer support directly impacts user confidence and overall satisfaction with the platform.Zoho Payroll offers a multi-faceted approach to customer support, aiming to cater to various user preferences and technical proficiencies.

This includes a blend of self-service options and direct interaction with support agents.

Customer Support Channels

Zoho Payroll provides several avenues for users to seek assistance. These channels are designed to offer a tiered approach, starting with readily available self-service resources and escalating to direct human interaction when necessary. This allows users to find solutions quickly and efficiently, minimizing downtime and frustration.

- Comprehensive Help Center: A vast knowledge base filled with articles, FAQs, video tutorials, and troubleshooting guides covers a wide range of topics. This is the first port of call for most users, often resolving issues independently.

- Email Support: For more complex issues or those not addressed in the Help Center, users can contact Zoho Payroll support via email. Response times vary but generally aim for a timely resolution.

- Phone Support: While not always readily available as a first-tier option, phone support is offered for urgent matters or situations requiring immediate assistance. This allows for direct communication and potentially faster problem-solving.

- Live Chat: Some plans may include access to live chat support, enabling real-time interaction with a support agent for immediate assistance with current issues.

- Community Forums: Zoho Payroll maintains online forums where users can connect, share experiences, and seek help from other users and Zoho experts. This collaborative approach can provide valuable insights and alternative solutions.

Positive Customer Support Experiences

Many users report positive experiences with Zoho Payroll’s support, often highlighting the comprehensiveness of the Help Center and the responsiveness of the support team. For example, several online reviews mention resolving complex payroll issues through the Help Center’s detailed articles and video tutorials. Other positive feedback focuses on the helpfulness and professionalism of support agents who efficiently address issues via email or phone.

These positive interactions contribute to user satisfaction and reinforce confidence in the platform’s reliability.

Negative Customer Support Experiences

While many experiences are positive, some users have reported negative experiences, primarily related to longer-than-expected response times for email support or difficulty navigating the Help Center for specific, niche issues. In some cases, users have expressed frustration with the lack of readily available phone support for lower-tier plans. These instances highlight areas where Zoho Payroll could potentially improve its support offerings to ensure consistent, high-quality service across all user segments.

However, these instances appear to be the exception rather than the rule, based on overall user feedback.

Zoho Payroll Reporting and Analytics

Zoho Payroll offers a robust suite of reporting and analytics tools designed to give you a clear picture of your payroll expenses, employee compensation, and overall financial health. These reports aren’t just for compliance; they’re powerful tools to help you make strategic decisions about your business. Understanding the data presented can lead to significant cost savings, improved employee satisfaction, and better financial planning.Zoho Payroll provides various reports categorized for easy access and interpretation.

These reports offer insights into different aspects of your payroll, allowing you to track key metrics and identify areas for improvement. This data-driven approach allows for proactive adjustments to your payroll strategy, leading to more efficient and effective management of your workforce.

Available Report Types in Zoho Payroll

Zoho Payroll offers a comprehensive range of reports, including but not limited to: salary reports, tax reports, employee compensation summaries, and detailed expense breakdowns. These reports can be customized to reflect specific date ranges, employee groups, or other relevant criteria. The platform also provides graphical representations of data to facilitate easier comprehension and identification of trends. For instance, you can easily visualize salary distributions across different departments or track the overall growth in payroll expenses over time.

Using Reports for Informed Business Decisions

The reports generated by Zoho Payroll are not merely static documents; they are dynamic tools for informed decision-making. By analyzing the data, businesses can identify areas of inefficiency, optimize compensation strategies, and ensure compliance with all relevant tax regulations. For example, a comparison of payroll costs across different departments might reveal that one department has significantly higher overtime expenses than others.

This information could trigger an investigation into the reasons behind this discrepancy, potentially leading to process improvements or adjustments in staffing levels.

Example Report and Interpretation: Employee Compensation Summary

Let’s consider the “Employee Compensation Summary” report. This report provides a detailed breakdown of each employee’s compensation, including their base salary, bonuses, deductions, and net pay. Imagine a scenario where this report shows that a particular employee’s total compensation is consistently higher than others in a similar role. This could be due to various factors, such as performance-based bonuses, additional benefits, or even errors in data entry.

Analyzing this data allows the business to identify and address potential inconsistencies, ensuring fair compensation practices and cost optimization. Further investigation might reveal that the employee has exceeded performance targets, justifying their higher compensation. Conversely, it could also highlight an error in the payroll system that needs to be corrected. In either case, the report provides the crucial information for informed decision-making.

Zoho Payroll Mobile App Functionality

Zoho Payroll’s mobile app aims to bring the core functionality of its desktop counterpart to your smartphone, allowing for on-the-go management of payroll tasks. While it doesn’t mirror every feature of the desktop version, it provides a streamlined experience for essential functions, making it a valuable tool for busy payroll administrators. The app’s user-friendliness is a key focus, making complex payroll tasks more accessible.The Zoho Payroll mobile app offers a subset of the desktop version’s features, prioritizing ease of access and speed for common tasks.

While some advanced functionalities might require the desktop interface, the app excels at providing quick access to crucial information and allowing for timely actions. The app’s design prioritizes intuitive navigation, making it easy to locate and use needed features, even for users less familiar with the desktop version.

Key Features of the Zoho Payroll Mobile App

The Zoho Payroll mobile app provides access to several key features, enabling users to manage payroll tasks efficiently from their mobile devices. These features include viewing employee information, approving timesheets, checking payroll processing status, and accessing essential reports. Notifications regarding upcoming payroll deadlines or important updates are also sent directly to the app, ensuring timely action.

Comparison of Mobile and Desktop Experiences

The mobile app experience prioritizes simplicity and speed. While it offers a significant portion of the desktop version’s functionality, the layout is simplified for mobile screens, focusing on the most frequently used tasks. The desktop version, on the other hand, offers a more comprehensive set of features and a more detailed view of payroll data. For instance, detailed report customization and complex employee data management are generally better suited for the desktop interface due to the larger screen real estate and more robust functionality.

The mobile app acts as a powerful tool for quick checks and essential approvals, while the desktop application remains the primary platform for in-depth analysis and comprehensive payroll management. Think of it like this: the mobile app is your quick-access tool for urgent tasks, while the desktop application is your comprehensive control center.

Zoho Payroll Implementation and Onboarding

Switching to a new payroll system can feel daunting, but with a structured approach, implementing Zoho Payroll in your small business can be smooth and efficient. This section provides a step-by-step guide and highlights common challenges to anticipate during the onboarding process. Remember, proper planning and preparation are key to a successful transition.

Step-by-Step Implementation Guide for Small Businesses

Successfully implementing Zoho Payroll involves several key steps. Following this structured approach will minimize disruptions and ensure a seamless transition.

- Account Setup and Configuration: Begin by creating your Zoho Payroll account. This involves providing basic company information, such as your business name, address, and tax ID. Carefully review and complete all required fields to ensure accurate data processing.

- Employee Data Entry: Next, input your employee data. This includes personal information (names, addresses, etc.), employment details (hire dates, job titles, etc.), and compensation information (pay rates, payment methods, etc.). Accurate data entry is crucial for accurate payroll calculations and reporting.

- Tax and Compliance Setup: Configure your tax settings based on your location and legal requirements. This involves entering necessary tax IDs and rates. Zoho Payroll provides guidance on compliance, but consulting with a tax professional is always advisable to ensure accuracy and avoid potential penalties.

- Payment Method Configuration: Determine your preferred payment methods for employees (direct deposit, checks, etc.). Set up the necessary banking information within Zoho Payroll to facilitate seamless and timely payments.

- Test Run and Verification: Before processing your first official payroll, conduct a test run with a small sample of employee data. This allows you to identify and correct any errors in your setup before impacting your entire workforce. Verify all calculations to ensure accuracy.

- Go-Live and Ongoing Management: Once you’ve completed the test run and are confident in the accuracy of your data, you can officially go live with Zoho Payroll. Remember that ongoing management is crucial. Regularly review and update employee information and tax settings to maintain compliance.

Challenges During Onboarding

Several challenges are commonly encountered during the Zoho Payroll onboarding process. Understanding these potential hurdles allows for proactive mitigation strategies.

- Data Migration: Transferring existing employee data from a previous system can be time-consuming and prone to errors. Thorough data validation is crucial to avoid inaccuracies in payroll calculations.

- System Integration: Integrating Zoho Payroll with existing HR or accounting systems may require technical expertise and careful planning. Potential incompatibility issues should be addressed proactively.

- Training and Adoption: Adequate training for employees and payroll administrators is essential to ensure efficient use of the system. Lack of training can lead to errors and delays.

- Compliance and Regulatory Changes: Staying current with tax laws and regulations is vital. Zoho Payroll provides updates, but internal processes should be in place to manage compliance effectively.

- Unexpected Issues and Troubleshooting: Despite thorough planning, unexpected technical issues or data discrepancies may arise. Having a support plan in place, including access to Zoho’s customer support, is critical for timely resolution.

Zoho Payroll for Different Business Sizes

Zoho Payroll’s strength lies in its adaptability. It’s not a one-size-fits-all solution; instead, it scales effectively to meet the payroll needs of businesses ranging from solo entrepreneurs to large corporations. The core functionality remains consistent, but the depth of usage and the features leveraged vary significantly depending on the size and complexity of the organization.Zoho Payroll’s scalability is achieved through a modular approach.

Basic features are available to all users, while more advanced capabilities, like those for complex compensation structures or robust reporting, are unlocked through higher-tier plans. This allows small businesses to start with a cost-effective plan and upgrade as their needs evolve. Larger businesses can utilize the full suite of tools to manage their payroll efficiently across multiple locations and departments.

Zoho Payroll for Small Businesses

Small businesses, often characterized by a limited number of employees and simpler payroll structures, can benefit significantly from Zoho Payroll’s ease of use and affordability. Features like automated tax calculations, direct deposit processing, and basic reporting tools streamline payroll management, freeing up valuable time for other business priorities. For example, a small bakery with five employees can easily manage payroll, including calculating employee wages, withholding taxes, and generating pay stubs, all within the intuitive Zoho Payroll interface.

The simplicity and low cost of entry make it an ideal solution for businesses just starting out or those with limited administrative resources.

Zoho Payroll for Medium-Sized Businesses

Medium-sized businesses typically require more sophisticated payroll management capabilities. Zoho Payroll addresses this need by providing features such as advanced reporting, multi-location support, and the ability to handle complex compensation structures including commissions and bonuses. A medium-sized marketing agency with multiple projects and teams, for instance, can utilize Zoho Payroll to track employee hours across different projects, allocate payments accurately, and generate comprehensive reports for budgeting and performance analysis.

The system’s ability to manage multiple payrolls and employee types is particularly valuable in this context.

Zoho Payroll for Large Enterprises

Large enterprises often have complex payroll requirements, including managing numerous employees across various locations, handling diverse compensation plans, and ensuring compliance with multiple tax regulations. Zoho Payroll offers robust features to meet these challenges. Features such as integration with HR systems, advanced security protocols, and customizable reporting capabilities ensure compliance and efficiency. For example, a large multinational corporation can leverage Zoho Payroll’s integration capabilities to streamline data flow between its payroll, HR, and accounting systems.

The system’s scalability allows it to handle a large volume of employee data and transactions while maintaining accuracy and security. The advanced reporting features also enable the organization to gain valuable insights into payroll costs and employee compensation trends.

Wrap-Up

Ultimately, Zoho Payroll presents a compelling solution for businesses seeking to automate and optimize their payroll processes. While it boasts a user-friendly interface and robust feature set, careful consideration of pricing tiers, integration needs, and specific business requirements is crucial. By weighing the pros and cons Artikeld in this deep dive, businesses can determine if Zoho Payroll aligns with their unique needs and contributes to a more efficient and streamlined workflow.

FAQ Corner: Zoho Payroll

Can I integrate Zoho Payroll with my existing accounting software?

Yes, Zoho Payroll integrates with several popular accounting software options. Check Zoho’s website for a complete list of compatible applications.

What types of payment methods does Zoho Payroll support?

Zoho Payroll typically supports direct deposit and potentially other methods depending on your location and plan. Check their website for details specific to your region.

Does Zoho Payroll offer a free trial?

Many payroll providers, including Zoho, often offer free trials. Visit their official website to see current offerings.

What happens if I make a mistake in payroll processing?

Zoho Payroll usually has correction features. However, contacting their support team immediately is crucial to minimize potential issues.

Is my data secure with Zoho Payroll?

Zoho Payroll employs industry-standard security measures to protect user data, complying with relevant regulations like GDPR. Details on their security practices are usually available on their website.